Business Insurance in and around Middletown

Calling all small business owners of Middletown!

Cover all the bases for your small business

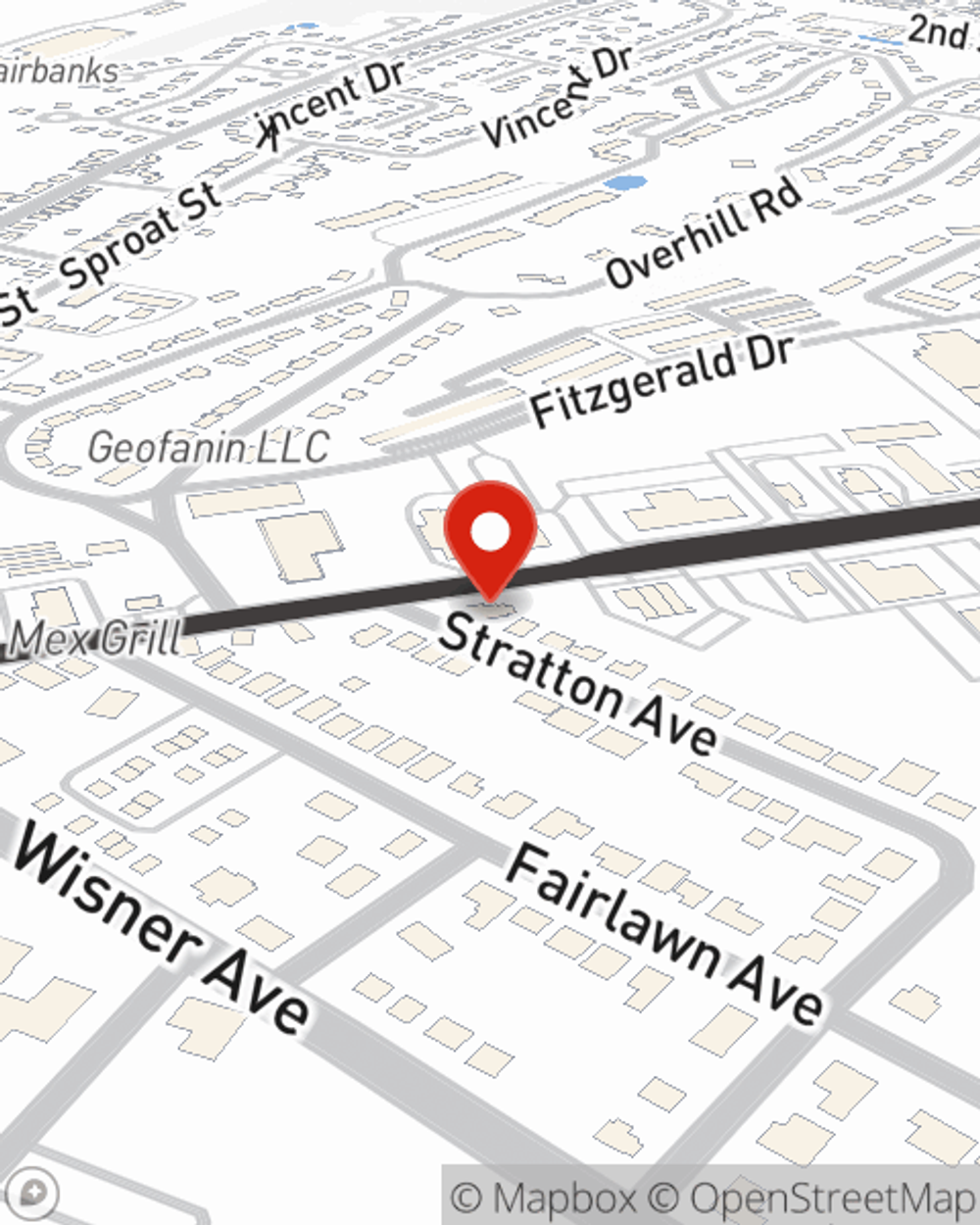

- Middletown NY

- Scotchtown NY

- Mechanicstown NY

- Otisville NY

- Bloomingburg NY

- Campbell Hall

- Slate Hill NY

- Wurtsboro NY

- Monticello NY

- Port Jervis NY

- Milford PA

- Warwick NY

- Florida NY

- Chester NY

- West Milford NJ

- Wantage NJ

- Franklin NJ

- Monroe NY

- Orange County NY

- Ulster County NY

- Rockland County

- Westchester County

- Sullivan County NY

- Wayne NJ

Your Search For Great Small Business Insurance Ends Now.

Preparation is key for when something unavoidable happens on your business's property like a customer stumbling and falling.

Calling all small business owners of Middletown!

Cover all the bases for your small business

Small Business Insurance You Can Count On

With State Farm small business insurance, you can give yourself more protection! State Farm agent Cassie Gleeson is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Cassie Gleeson can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let fears about your business keep you up at night! Contact State Farm agent Cassie Gleeson today, and find out how you can meet your needs with State Farm small business insurance.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Cassie Gleeson

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.